Profitability ratios are key indicators of a company’s ability to generate profit relative to its sales, assets, or equity. These ratios give a clear picture of how effectively a company is turning its resources into earnings. By examining profitability ratios such as gross profit margin, net profit margin, return on assets (ROA), and return on equity (ROE), businesses and investors alike can assess the financial performance and growth potential

1. Key Profitability Ratios

Profitability ratios help measure how efficiently a company generates profit from its resources.

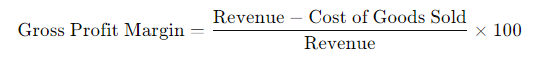

1.1. Gross Profit Margin is a critical profitability ratio that shows how efficiently a company is producing goods or services. It’s calculated by subtracting the cost of goods sold (COGS) from total revenue, then dividing by revenue. The formula is:

This ratio helps businesses assess their production efficiency by showing what percentage of revenue is retained as gross profit. A higher gross profit margin indicates more efficient production and cost control.

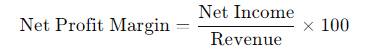

1.2. Net Profit Margin is a key profitability ratio that measures the percentage of revenue that remains as net income after all expenses, taxes, and interest have been deducted. The formula is:

This ratio reveals how much profit a company generates from every dollar of revenue. A higher net profit margin indicates better control over costs and expenses, resulting in stronger profitability. It’s crucial for evaluating overall financial efficiency.

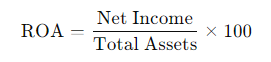

1.3. Return on Assets (ROA) measures how efficiently a company uses its assets to generate profit. It’s calculated by dividing net income by total assets. The formula is:

This ratio indicates how well a company turns its investments into earnings. A higher ROA means the company is effectively using its assets to produce income. It’s a useful measure for comparing profitability across companies within the same industry.

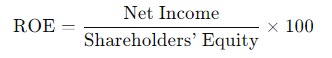

1.4. Return on Equity (ROE) is a key measure of how effectively a company generates profit from its shareholders’ equity. It shows how much profit is earned for every dollar of equity invested. The formula is:

A higher ROE indicates that a company is using its equity efficiently to generate profit. It’s a valuable tool for investors to assess how well a company is managing the money invested by its shareholders.

2. Interpreting Profitability Ratios

Interpreting profitability ratios requires understanding how they reflect a company’s ability to generate profit from its resources.

For example, a high gross profit margin suggests the company efficiently manages production costs, while a high net profit margin indicates strong overall profitability after accounting for all expenses. ROA shows how effectively assets are being used to generate income, and ROE measures how well a company is delivering returns to shareholders. Comparing these ratios across industry benchmarks and competitors can reveal strengths, weaknesses, and growth opportunities.

3. Practical Applications of Profitability Ratios

Profitability ratios offer invaluable insights for both management and investors. Businesses use ratios like gross profit margin and net profit margin to evaluate operational efficiency and control over production costs and expenses. ROA and ROE are vital for assessing how effectively a company utilizes assets and equity to generate returns, guiding decisions on resource allocation and investment strategies.

For investors, these ratios help compare companies within the same industry, identify strong performers, and determine potential risks and returns on investments.

Final Thoughts

Profitability ratios are vital tools for understanding a company’s ability to generate profits from its operations. By examining ratios such as gross profit margin, net profit margin, ROA, and ROE, businesses can assess how efficiently they manage their resources and how well they convert sales into profits. For investors, these ratios are key indicators of a company’s financial health and growth potential, helping them make informed decisions. Interpreting profitability ratios is essential for evaluating performance, guiding strategy, and maximizing long-term success.