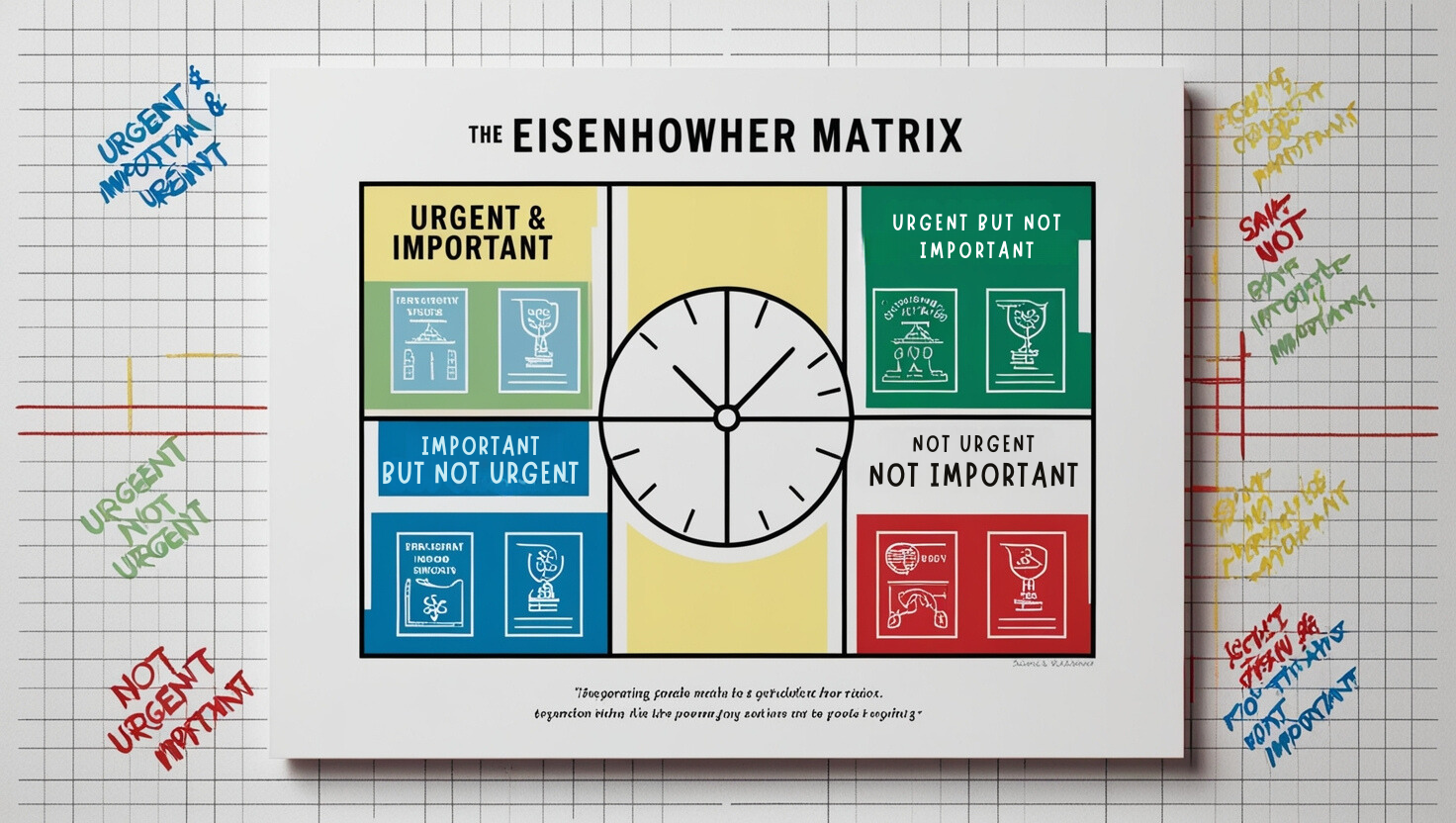

The Eisenhower Matrix offers a powerful approach to handling tasks by helping you decide what’s urgent, what’s important, and what can wait. This guide covers each quadrant in detail, showing you how to prioritize effectively and make real progress on meaningful goals, all while reducing stress and staying organized.

Category: Insights and Education

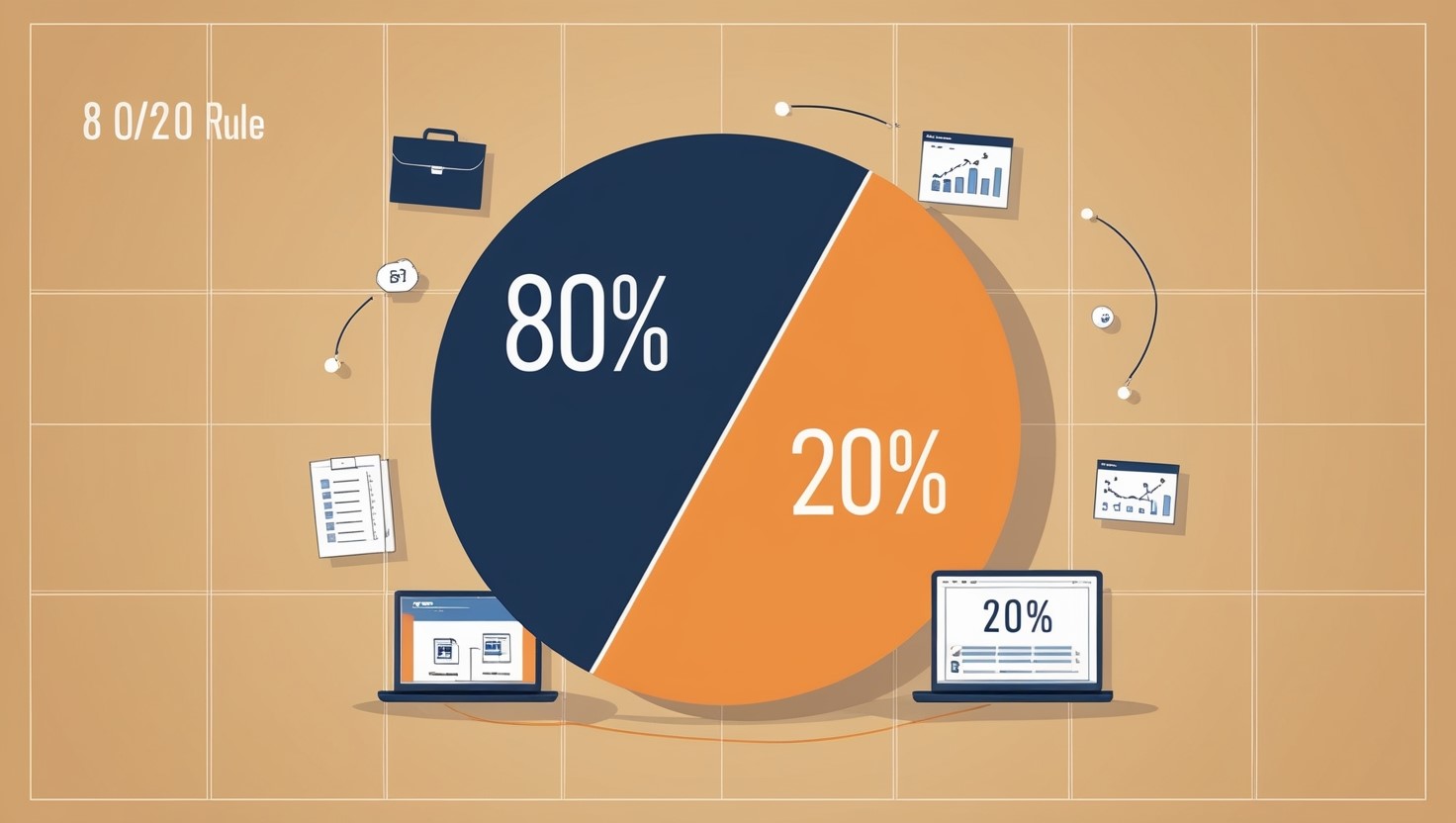

What is the 80/20 Rule in Business?

The 80/20 rule, also known as the Pareto Principle, offers a powerful way to focus on what drives the most impact in your business. By identifying and concentrating on the 20% of efforts that bring 80% of results, you can work smarter and achieve sustainable growth. Learn how to apply this approach to maximize productivity and profitability.

What Do the Points Mean in Stock Market?

Stock market points provide a quick snapshot of how major indexes like the Dow Jones, S&P 500, and NASDAQ are performing. Understanding what these points mean, and how they’re influenced by factors like volatility and market conditions, can help investors make more informed decisions.

Understanding of Financial Ratios – Market Value Ratios (FA #5)

Market value ratios are essential for evaluating a company’s stock value. From the P/E ratio to dividend yield, these ratios provide insights into whether a stock is overvalued or undervalued, helping investors make more informed decisions. Learn how to interpret and apply market value ratios for smarter investing.

Understanding of Financial Ratios – Efficiency Ratios (FA #4)

Efficiency ratios provide valuable insight into how well a company uses its resources to generate revenue. From asset turnover to inventory management, these ratios help investors and business owners understand how efficiently a company is operating. Learn how to calculate and interpret key efficiency ratios to make informed decisions.

Best Financial Market Data Service for Retail Investors

Access to reliable financial market data is essential for retail investors. Whether you need real-time updates, comprehensive analysis, or just an easy-to-use platform, finding the right data service can help you make smarter investment decisions. Explore the best free and premium options to suit your goals and budget.

Investing in Apartment Buildings: How to Scale Your Real Estate Portfolio

Scaling your real estate portfolio with apartment buildings offers the potential for increased cash flow, diversification, and long-term growth. This guide explores the key advantages, financing strategies, and management tips to help you confidently transition from single-family homes to multi-family properties and build a sustainable, profitable real estate business.

Understanding of Financial Ratios – Leverage Ratios (FA #3)

Leverage ratios are a vital part of analyzing a company’s financial health. They help assess how much debt a company uses relative to its equity, which influences its risk profile. Understanding these ratios aids in making informed investment and management decisions.

Top 10 Investing & Finance Movies and Tv Series You Should Watch in 2024

From gripping dramas like Billions that delve into the world of hedge funds, to documentary series like Dirty Money that exposes real-life corruption, these TV shows provide more than just entertainment—they offer insight into the complex world of money, power, and ethical dilemmas that define modern finance

How to Apply Numerology to Life and Finance

Numerology offers a fascinating approach to understanding personal traits, including how we manage finances. By calculating your Life Path number and exploring its significance, you can gain insight into your natural financial tendencies and strengths. This guide explains how numerology can shape your financial decisions and how to apply this knowledge for a more prosperous future.