Looking to boost your credit score quickly? From paying down balances to checking your credit report for errors, this guide covers practical steps to improve your score and take control of your financial future.

Daily Market Snapshot: October 31, 2024

On October 31, 2024, U.S. stocks fell sharply as Microsoft and Meta reported rising AI costs that worried investors. The Dow, S&P 500, and Nasdaq declined, with tech stocks leading losses. Energy stocks gained, while market sentiment remained cautious with the Fed meeting and U.S. election looming.

Daily Market Snapshot: October 30, 2024

On October 30, 2024, U.S. stocks closed lower as mixed tech earnings and weak semiconductor forecasts weighed on sentiment. The Dow, S&P 500, and Nasdaq all declined, with Alphabet’s gains offsetting some tech losses. Investors remain cautious as the Nov. 5 election and Fed rate decision loom.

Daily Market Snapshot: October 29, 2024

On October 29, 2024, the Nasdaq hit a record high, lifted by Alphabet’s strong earnings that fueled optimism for mega-cap tech stocks. While the S&P 500 also rose, the Dow Jones fell, weighed down by weaker results in non-tech sectors. Rising Treasury yields and a busy earnings season are keeping investor sentiment cautious.

“You Must Unlearn What You Have Learned”: What Does Master Yoda Mean?

Yoda’s advice to “unlearn what you have learned” holds a profound lesson for us all: by letting go of limiting beliefs and embracing change, we open ourselves to growth, resilience, and the freedom to see life with fresh eyes.

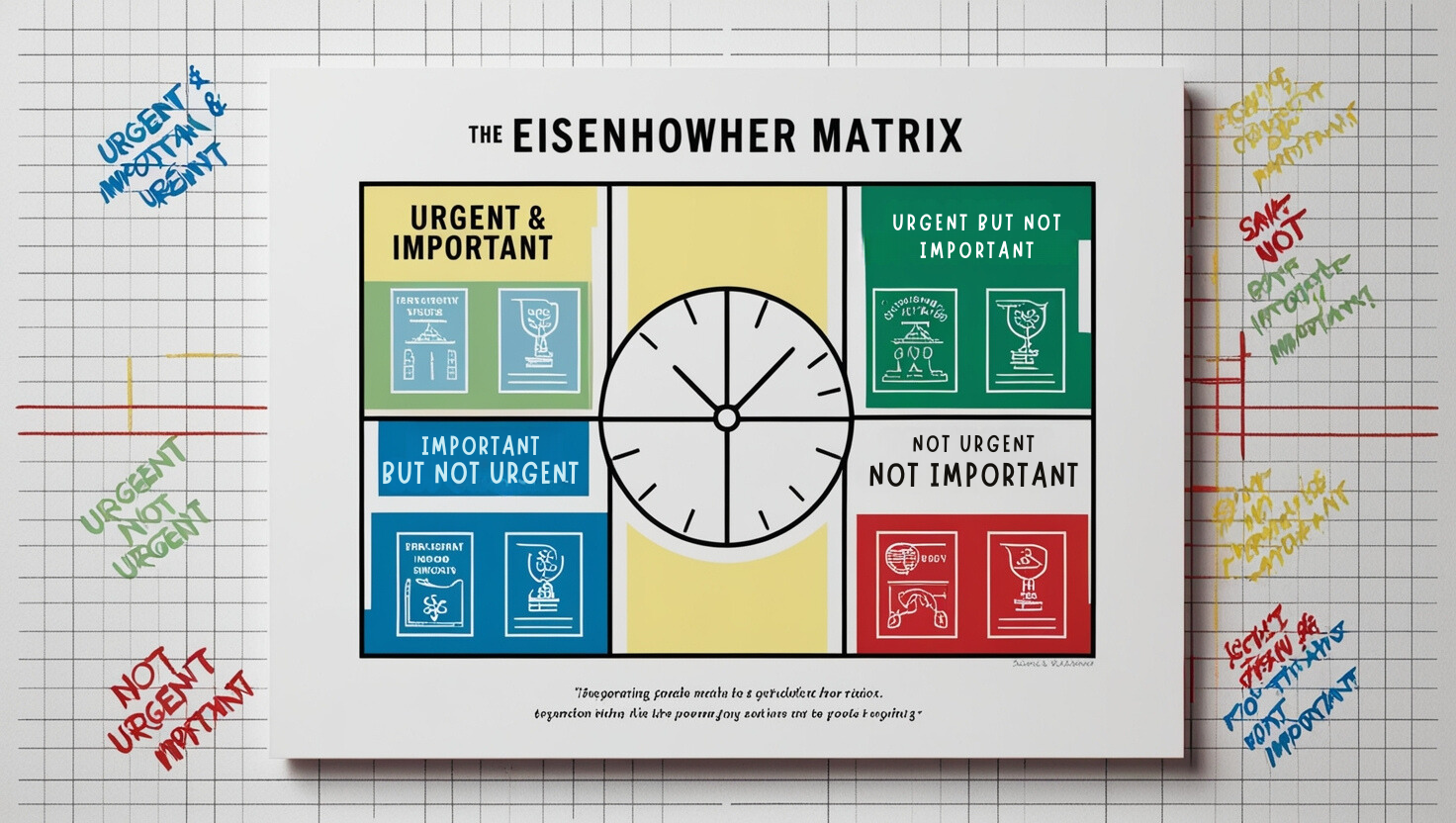

The Eisenhower Matrix: Mastering Your To-Do List

The Eisenhower Matrix offers a powerful approach to handling tasks by helping you decide what’s urgent, what’s important, and what can wait. This guide covers each quadrant in detail, showing you how to prioritize effectively and make real progress on meaningful goals, all while reducing stress and staying organized.

Daily Market Snapshot: October 28, 2024

On October 28, 2024, U.S. stocks closed higher, with the Dow leading gains as investors prepared for a crucial earnings week. Mega-cap tech stocks rose ahead of key reports, while the energy sector lagged as crude oil prices fell. Cautious optimism prevails as investors monitor economic data, Fed policy, and election uncertainties.

How to Save money While paying off Debt

Balancing debt repayment with savings is challenging but achievable. With a practical budget, smart debt strategies, and a focus on long-term goals, you can work toward financial stability and build a secure future.

Mastering Control Over Impulse Buying: Your Guide to Lasting Change

Impulse buying can feel satisfying in the moment, but it often leads to financial regret. Learn how to build healthy spending habits with practical tips for managing impulses, setting goals, and creating a balanced, lasting approach to your money.

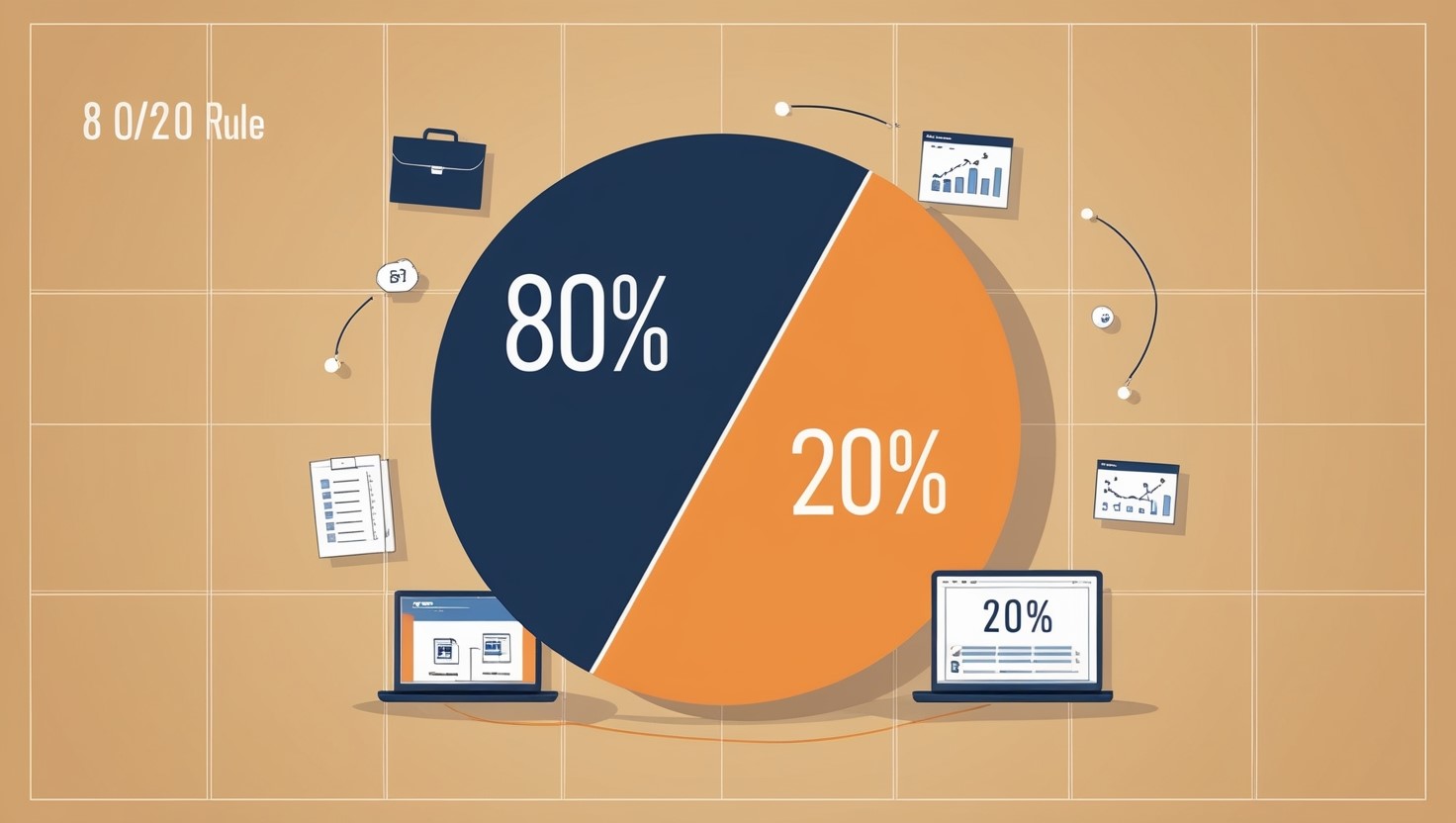

What is the 80/20 Rule in Business?

The 80/20 rule, also known as the Pareto Principle, offers a powerful way to focus on what drives the most impact in your business. By identifying and concentrating on the 20% of efforts that bring 80% of results, you can work smarter and achieve sustainable growth. Learn how to apply this approach to maximize productivity and profitability.