Setting clear, actionable investment goals is a crucial first step in building a successful investment strategy. These goals will guide your decisions, help you stay focused, and ensure that your investments align with your financial needs and time horizon. In this module, we’ll explore how to set realistic investment goals based on your personal circumstances and financial objectives.

2.1 Why Setting Investment Goals is Important

Setting clear investment goals is a fundamental step toward building a successful financial future. Without defined goals, it’s challenging to create an investment strategy that aligns with your needs, risk tolerance, and financial aspirations. Here are the key reasons why setting investment goals is essential:

2.1.1 Provides Clarity and Direction

- Purposeful Investing: Setting specific investment goals gives you a clear sense of purpose. It helps you understand why you are investing and what you want to achieve, whether it’s saving for retirement, a child’s education, or a down payment on a house.

- Focus: By having defined goals, you can stay focused on what matters most to you financially. Instead of making random investment choices, your strategy will be driven by your long-term financial objectives.

2.1.2 Helps in Making Informed Decisions

- Tailored Investment Choices: Clear goals help you choose the right types of investments. For example, if you are saving for a short-term goal, you may opt for safer, more liquid investments like bonds or money market accounts. For long-term goals, higher-risk investments like stocks may be more appropriate, as you have more time to weather market fluctuations.

- Risk Management: Knowing your goals allows you to assess how much risk you are willing to take. You can align your investments with your risk tolerance, ensuring you are comfortable with the potential volatility of your portfolio.

2.1.3 Offers Measurable Progress

- Tracking Success: With defined goals, you can track your progress and measure how close you are to achieving them. This provides a sense of accomplishment and motivation to continue investing.

- Adjustments: If you see that you’re not on track to meet your goals, you can make necessary adjustments, such as increasing your contributions, rebalancing your portfolio, or changing your investment approach.

2.1.4 Keeps You Disciplined

- Avoiding Impulse Decisions: Clear investment goals help you avoid making impulsive decisions based on short-term market movements or emotions. When you know your destination, you’re less likely to be swayed by temporary market volatility or fear of missing out on speculative investments.

- Consistency: Goals encourage consistent investing. Whether through automated contributions or regular review of your portfolio, having a clear target helps ensure that you stay disciplined and committed to your financial plan.

2.1.5 Aligns Investments with Life Milestones

- Life-Stage Planning: Investment goals are often tied to important life milestones, such as buying a home, retiring, or funding your child’s education. By setting goals, you can match your investment strategy with your current life stage and future aspirations, ensuring your investments work in tandem with your evolving needs.

2.1.6 Maximizes the Benefits of Compounding

- Early Action: Setting investment goals early allows you to take full advantage of compound interest. The longer your investments have to grow, the more exponential the growth can be. Starting early with clear goals gives your money more time to accumulate wealth over the long term.

- Focused Growth: With goals in place, you can harness the power of compounding effectively by consistently reinvesting your returns toward the achievement of those goals.

2.1.7 Provides a Roadmap for Financial Independence

- Step-by-Step Progress: Investment goals give you a roadmap for achieving financial independence. By setting short-term, medium-term, and long-term goals, you create a path that leads to financial security and independence over time.

- Achieving Milestones: Each goal you achieve moves you closer to larger financial aspirations, such as retirement, purchasing property, or creating a legacy for your family.

2.1.8 Conclusion of Why Setting Investment Goals is Important

Setting investment goals is the foundation for creating a successful financial strategy. It provides clarity, helps you make informed decisions, keeps you disciplined, and allows you to measure progress. Whether your goals are short-term or long-term, defining them ensures that your investments align with your personal needs and financial aspirations, ultimately guiding you toward financial independence and security.

In the next section, we’ll explore the different types of investment goals and how to approach each based on your time horizon and risk tolerance.

2.2 Types of Investment Goals

Investment goals vary depending on the time horizon and the specific financial objectives you want to achieve. Broadly, these goals can be categorized into three types: short-term, medium-term, and long-term. Each type of goal requires a different investment approach based on the level of risk you’re willing to take and how soon you’ll need the money.

2.2.1 Short-Term Goals (1-3 Years)

- Definition: Short-term goals are financial objectives that you aim to achieve within one to three years. These goals typically require access to cash in a short period of time and cannot afford significant risk.

- Examples:

- Building an emergency fund

- Saving for a vacation

- Buying a car

- Covering upcoming medical expenses

- Investment Approach:

- Low-Risk Investments: For short-term goals, it’s essential to prioritize safety and liquidity. The focus should be on preserving your capital while earning a modest return.

- Options: High-yield savings accounts, certificates of deposit (CDs), money market accounts, or short-term government bonds. These investments offer stability and easy access to funds, minimizing the risk of loss.

- Goal: Protect your principal while earning small returns, ensuring the money is available when you need it.

2.2.2 Medium-Term Goals (3-10 Years)

- Definition: Medium-term goals are financial objectives with a time horizon of three to ten years. These goals allow for a balance between growth and stability, as you have more time than short-term goals but still need the money sooner than long-term goals.

- Examples:

- Saving for a house down payment

- Paying for a wedding or college education

- Starting a business

- Investment Approach:

- Moderate-Risk Investments: For medium-term goals, you can take on more risk than with short-term goals but still need to manage volatility carefully. You’ll want to balance growth potential with capital preservation.

- Options: A mix of bonds, dividend-paying stocks, balanced mutual funds, or exchange-traded funds (ETFs). These investments provide moderate growth potential while limiting downside risk.

- Diversification: A diversified portfolio of stocks and bonds helps reduce risk while allowing for growth over time.

- Goal: Grow your investments at a moderate rate without exposing yourself to excessive risk.

2.2.3 Long-Term Goals (10+ Years)

- Definition: Long-term goals are financial objectives that are at least ten years away. Because of the extended time horizon, long-term goals allow you to take on more risk, which can lead to higher potential returns.

- Examples:

- Saving for retirement

- Building a substantial education fund for children

- Buying a dream home

- Wealth-building and legacy planning

- Investment Approach:

- High-Risk, High-Reward Investments: For long-term goals, you have the luxury of time, which allows you to take on more risk. Investments like stocks and real estate offer the potential for higher returns over the long run.

- Options: A portfolio heavily weighted toward stocks, real estate investments, and growth-oriented mutual funds or ETFs. These investments are more volatile in the short term but historically offer strong returns over decades.

- Compound Interest: The longer time horizon allows you to fully benefit from compound interest, where the returns you earn on your investments generate additional returns over time.

- Goal: Maximize growth and capitalize on market opportunities, knowing that you have time to recover from short-term volatility.

2.2.4 Aligning Time Horizon with Risk Tolerance

- Time Horizon: Your time horizon refers to the amount of time you have until you need access to the money you’re investing. The longer your time horizon, the more risk you can afford to take because you have more time to ride out market fluctuations.

- Risk Tolerance: Your risk tolerance is your ability and willingness to endure losses in the pursuit of higher returns. For short-term goals, you may have a lower risk tolerance since you need the money soon. For long-term goals, you can take more risks because you have time to recover from market downturns.

2.2.5 Diversifying Across Goals

- Multiple Goals: Most investors have a combination of short-term, medium-term, and long-term goals. It’s important to diversify your investment strategy across these different time horizons, using low-risk investments for short-term needs and more aggressive investments for long-term growth.

- Resource Allocation: Allocate resources based on the urgency and importance of each goal. For example, if retirement is your primary focus, more of your resources may be allocated to long-term investments. If buying a home in five years is your priority, focus on safer, medium-term options.

2.2.6 Conclusion of Types of Investment Goals

Each type of investment goal requires a different approach to risk, return, and time horizon. Understanding your short-term, medium-term, and long-term goals helps you create a tailored investment strategy that balances your need for stability, growth, and accessibility. As you prioritize your goals, you can allocate your resources to ensure that your investments are working toward achieving your specific financial objectives.

In the next section, we will explore how to align your risk tolerance with your investment goals, helping you create a well-balanced portfolio that meets your financial needs.

2.3 Aligning Risk Tolerance with Goals

Aligning your investment goals with your risk tolerance is crucial for creating a strategy that not only helps you achieve your financial objectives but also ensures that you are comfortable with the potential ups and downs of the market. Understanding your personal risk tolerance will guide you in selecting investments that match your time horizon, financial needs, and emotional capacity to handle market fluctuations.

2.3.1 What is Risk Tolerance?

- Definition: Risk tolerance is the degree of variability in investment returns that you are willing to withstand. It reflects your comfort level with losing money in the short term in exchange for the potential of long-term gains.

- Factors Influencing Risk Tolerance:

- Age: Younger investors typically have a higher risk tolerance because they have more time to recover from market downturns.

- Financial Situation: Investors with more disposable income or assets may feel more comfortable taking on higher risk.

- Investment Experience: Experienced investors may have a better understanding of how to navigate market volatility, increasing their risk tolerance.

- Emotional Comfort: Some investors can tolerate seeing their portfolio values drop without panicking, while others may prefer more stable, conservative investments.

2.3.2 Assessing Your Risk Tolerance

- Risk Tolerance Questionnaire: Many financial institutions offer risk tolerance questionnaires that can help you gauge your willingness to take on risk. These tools assess your comfort with volatility, financial goals, and how you would react to losses.

- Self-Assessment: Ask yourself how you would feel if your investments dropped by 10%, 20%, or more. If you know that a significant market drop would cause you anxiety or prompt you to sell investments in a panic, you likely have a lower risk tolerance.

- Reviewing Past Behavior: If you’ve invested in the past, consider how you reacted during periods of market volatility. Did you stay the course, or did you feel compelled to sell your investments?

2.3.3 Risk Tolerance and Time Horizon

Your investment time horizon—how long you plan to hold your investments—plays a major role in determining how much risk you can take. Generally, the longer your time horizon, the more risk you can afford to take, as you have more time to recover from potential losses.

- Short-Term Goals (1-3 Years):

- Low Risk Tolerance: For short-term goals, such as saving for a vacation or buying a car, capital preservation is key. You cannot afford to lose money, as you’ll need access to it soon.

- Investment Approach: Low-risk investments, such as savings accounts, certificates of deposit (CDs), or short-term bonds, are ideal for short-term goals. They offer stability and liquidity, ensuring your money will be available when you need it.

- Medium-Term Goals (3-10 Years):

- Moderate Risk Tolerance: For medium-term goals, such as saving for a house down payment or a child’s education, you can afford to take on a bit more risk but still need a level of safety.

- Investment Approach: A balanced portfolio of bonds and stocks, or conservative mutual funds and ETFs, can provide both growth and stability. This balance ensures that you’re protecting your capital while also aiming for moderate returns over time.

- Long-Term Goals (10+ Years):

- High Risk Tolerance: For long-term goals, such as retirement or building wealth, you can afford to take on more risk because of your extended time horizon. Market downturns become less impactful as you have more time to ride out the volatility.

- Investment Approach: A portfolio heavily weighted toward stocks, real estate, or growth-oriented funds is suitable for long-term goals. These investments offer higher potential returns but also come with greater short-term fluctuations. Over time, the likelihood of achieving higher returns increases.

2.3.4 Matching Investment Strategies to Risk Tolerance

- Low Risk Tolerance:

- Goal: Capital preservation and stability.

- Ideal Investments: Bonds, savings accounts, money market funds, and conservative mutual funds. These investments offer lower returns but come with much less volatility, ensuring your money is secure.

- Suitable for: Short-term and medium-term goals where access to funds and protection of capital is essential.

- Moderate Risk Tolerance:

- Goal: Balanced growth with a focus on managing downside risk.

- Ideal Investments: A mix of stocks and bonds, balanced mutual funds, or ETFs. These investments offer a combination of stability and growth, helping you achieve moderate returns while keeping risk under control.

- Suitable for: Medium-term goals and investors seeking a balance between growth and risk management.

- High Risk Tolerance:

- Goal: Maximizing long-term growth with an acceptance of market volatility.

- Ideal Investments: Stocks, real estate, and growth-oriented mutual funds or ETFs. These investments offer higher potential returns but also come with higher short-term risk. Over the long run, these risks tend to be smoothed out.

- Suitable for: Long-term goals where the primary focus is growth, and the investor can tolerate significant market fluctuations.

2.3.5 Adjusting Risk Tolerance Over Time

- Life Changes: As your life circumstances change—whether through marriage, having children, or nearing retirement—your risk tolerance may shift. It’s important to revisit your risk tolerance regularly and adjust your investments as needed.

- Near Retirement: As you approach retirement, your risk tolerance may decrease, and you might shift your portfolio toward safer investments to protect your capital.

- Early in Career: If you’re early in your career, you may have a higher risk tolerance and be willing to invest more aggressively for long-term growth.

2.3.6 Rebalancing Your Portfolio

- Definition: Rebalancing involves adjusting your portfolio periodically to maintain your desired risk level. Over time, certain assets may outperform others, causing your portfolio to shift from its original risk allocation.

- Why It Matters: If your risk tolerance changes, you’ll need to rebalance your portfolio to reflect those changes. For example, if stocks perform well and now make up a larger portion of your portfolio than intended, rebalancing may involve selling some of those stocks and shifting into bonds or other lower-risk assets to realign with your risk tolerance.

2.3.7 Conclusion of Aligning Risk Tolerance with Goals

Aligning your risk tolerance with your investment goals is a key step in building a portfolio that matches both your financial objectives and your comfort level with risk. By understanding how much risk you can take and considering your time horizon, you can select the right mix of investments for each goal. Regularly reassessing your risk tolerance and rebalancing your portfolio ensures that your investment strategy remains aligned with your evolving financial needs.

In the next section, we will discuss the role of Compound Interest in setting and achieving your investment goals, and how it can significantly boost your portfolio’s growth over time.

2.4 The Role of Compound Interest in Goal-Setting

Compound interest is one of the most powerful tools in building long-term wealth and achieving your investment goals. It allows your investments to grow exponentially over time by earning interest not only on your initial investment but also on the interest that has already been added. Understanding the role of compound interest can help you set realistic and achievable financial goals, especially for long-term objectives.

2.4.1 What is Compound Interest?

- Definition: Compound interest is the process by which the interest you earn on an investment is reinvested, generating additional interest. Over time, this leads to exponential growth, as the interest earned starts earning its own interest.

- How It Works: When you invest money and earn returns, those returns are added to your principal, and future returns are calculated on the new, larger amount. This creates a “snowball effect” where your investment grows at an accelerating rate over time.

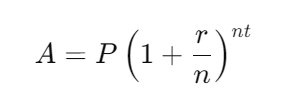

- Formula:

- Where:

- A = the future value of the investment/loan, including interest

- P = the principal investment amount (initial deposit or loan)

- r = annual interest rate (decimal)

- n = number of times that interest is compounded per unit of time

- t = the time the money is invested for (in years)

2.4.2 The Power of Time in Compound Interest

- Time is Key: The most critical factor in harnessing the power of compound interest is time. The longer you keep your money invested, the more compound interest will work in your favor, as the growth accelerates over the years.

- Example: Let’s say you invest $10,000 at a 7% annual return, and you leave the money invested for 30 years. Over time, compound interest will grow your investment to approximately $76,122, even if you never add more money. If you leave it for 40 years, it grows to $149,745, nearly doubling in the extra decade.

- Starting Early: The earlier you start investing, the more time you give compound interest to work its magic. Even small contributions early on can grow into substantial sums over time.

2.4.3 Compound Interest and Long-Term Goals

- Retirement Planning: Compound interest is particularly powerful when applied to long-term goals like retirement. By consistently contributing to a retirement account and reinvesting returns, your money will grow significantly over decades.

- Example: If you start investing $5,000 per year at age 25 in an account earning an average annual return of 7%, by age 65, your investment will have grown to approximately $1.1 million. If you start at age 35, your investment would grow to around $540,000 by age 65, even though you contributed the same amount each year.

- College Savings: For parents saving for a child’s education, starting early gives compound interest more time to grow those savings. For example, investing in a 529 college savings plan when a child is born allows 18 years of compounding to accumulate.

2.4.4 Compound Interest and Medium-Term Goals

- House Down Payment: If you’re saving for a house down payment over 5 to 10 years, compound interest can still play a significant role in boosting your savings. While the shorter time horizon won’t allow for the same exponential growth as long-term goals, consistently investing in a diversified portfolio can still provide a notable increase over time.

- Example: If you invest $10,000 at an annual return of 5% and leave it for 10 years, your investment will grow to approximately $16,470. The compounding effect is less dramatic than in long-term goals but still valuable.

2.4.5 Compound Interest and Short-Term Goals

- Less Impact for Short-Term Goals: Compound interest is less effective for short-term goals (1-3 years) because the time horizon is too short for significant compounding to occur. For short-term goals, the priority should be on liquidity and capital preservation rather than maximizing compounding.

- Example: If you invest $10,000 for three years at a 2% return, your investment will only grow to approximately $10,612. The short time frame means that the compounding effect is limited.

2.4.6 The Impact of Regular Contributions

- Consistent Investing: The power of compound interest is amplified when you make regular contributions to your investments. By consistently adding to your investment—whether monthly or annually—you increase the principal, which in turn generates more interest.

- Example: If you invest $5,000 per year for 20 years at an average annual return of 7%, your investment would grow to approximately $219,000. Without additional contributions, the same initial investment of $5,000 would only grow to about $19,348 over the same period.

- Automating Contributions: Setting up automatic contributions to your investment accounts ensures that you’re consistently adding to your principal, allowing compound interest to work more effectively.

2.4.7 Compound Interest and Inflation

- Beating Inflation: Inflation reduces the purchasing power of your money over time, so it’s important that your investments grow at a rate that exceeds inflation. Compound interest can help you achieve this, especially with long-term investments in stocks or real estate, which tend to outperform inflation.

- Real Returns: When considering compound interest, focus on the real return—the return on your investments after accounting for inflation. For example, if your investment grows at 7% annually and inflation averages 2%, your real return is 5%, which is where your wealth truly grows.

2.4.8 Using Compound Interest to Set Realistic Goals

- Goal Setting with Compound Interest: When setting investment goals, it’s important to factor in compound interest to determine how much you need to invest and how long it will take to reach your goals.

- Example: If your goal is to save $100,000 for retirement in 20 years, and you expect an average return of 6% annually, you would need to invest about $3,086 per year to reach that goal, thanks to the power of compound interest.

- Start Early, Save Less: The earlier you start investing, the less money you need to save each year to achieve the same goal, as compound interest does much of the heavy lifting over time.

2.4.9 Conclusion of The Role of Compound Interest in Goal-Setting

Compound interest is a critical factor in growing your investments and achieving your financial goals, especially for long-term objectives like retirement or wealth building. By understanding how compound interest works and the importance of starting early, you can set realistic goals and create an investment strategy that maximizes growth. Whether you’re contributing regularly or letting your initial investment grow over time, compound interest is one of the most effective tools for turning small amounts of money into significant wealth.

In the next section, we will explore how to prioritize your goals and allocate resources effectively to ensure you’re on track to achieving them.